Key figures

| | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Net debt, EUR million | 292 | 535 | 771 | 850 | 759 |

| Gearing, % | 16 | 32 | 46 | 63 | 66 |

| Equity ratio, % | 53 | 48 | 46 | 43 | 43 |

| Net debt to operative EBITDA | 0.5 | 0.8 | 1.3 | 2.0 | 1.7 |

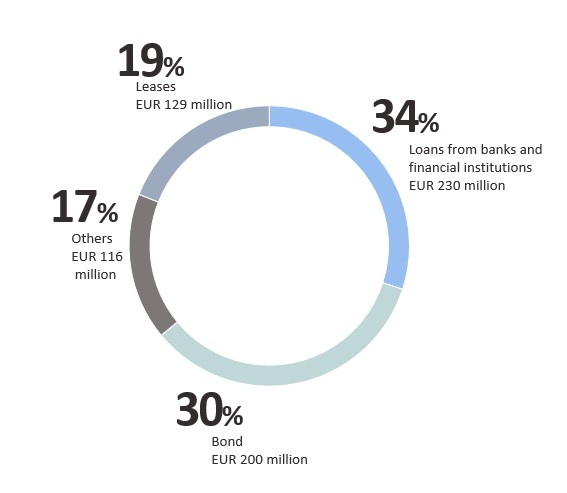

Gross debt EUR 671 million at the end of March 2025

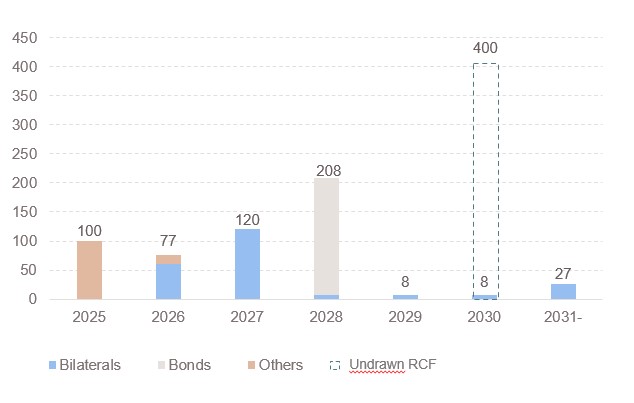

Gross debt maturity profile EUR 671 million at the end of March 2025

Kemira’s Outstanding Bonds:

| Amount | Issued | Maturing | Interest* | Listing prospectus |

|---|---|---|---|---|

| EUR 200 million | March 30, 2021 | March 30, 2028 | 1.000% | Prospectus |

* with a fixed annual interest

Releases

March 31, 2021:

Listing prospectus for Kemira Oyj’s EUR 200 million bond available

March 22, 2021:

Kemira Oyj announces final tender offer results

Kemira Oyj issues a EUR 200 million bond

Kemira Oyj announces indicative tender offer results

March 15, 2021

Kemira Oyj considers issuance of new notes and announces voluntary tender offer for its outstanding notes maturing in May 2022

April 17, 2019

Kemira signs revolving credit facility linked to sustainability targets

February 19, 2018

Kemira Oyj and the Nordic Investment Bank (NIB) have signed EUR 90 million loan agreement

May 31, 2017

Listing prospectus for Kemira Oyj’s EUR 200 million bond available

May 18, 2017

Kemira Oyj announces final tender offer results

Kemira Oyj issues a EUR 200 million bond

May 13, 2015

Listing prospectus for Kemira Oyj’s EUR 150 million bond available

May 6, 2015

Kemira Oyj issues a EUR 150 million bond

May 27, 2014

Listing prospectus for Kemira Oyj’s EUR 200 million bond available

May 20, 2014

Kemira Oyj issues a EUR 200 million bond

December 11, 2013

Kemira and European Investment Bank (EIB) signed EUR 45 million research and development loan agreement on December 11, 2013

August 29, 2013

Kemira Oyj signed EUR 400 million revolving credit facility on August 29, 2013