Dividend policy

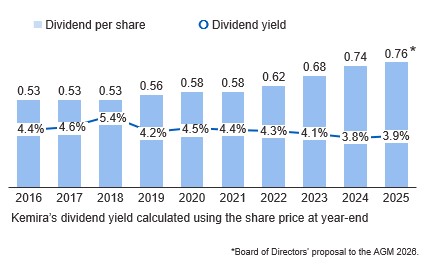

Kemira’s dividend policy aims at paying a competitive and over time increasing dividend.

Dividend for the financial year 2025

Kemira Oyj’s Board of Directors proposes to the Annual General Meeting to be held on March 19, 2026, that a dividend of EUR 0.76 per share, totaling EUR 114 million, be paid on the basis of the adopted balance sheet for the financial year that ended on December 31, 2025. The dividend will be paid in two installments. The first installment, EUR 0.38 per share, will be paid to shareholders who are registered in the company’s shareholder register, maintained by Euroclear Finland Ltd., on the record date for the dividend payment: March 23, 2026. The Board of Directors proposes that the first installment of the dividend be paid out on April 8, 2026. The second installment, of EUR 0.38 per share, will be paid in October 2026. The second installment will be paid to shareholders who are registered in the company’s shareholder register, maintained by Euroclear Finland Ltd., on the record date for the dividend payment. The Board of Directors will decide the record date and the payment date for the second installment at its meeting in October 2026. The record date is planned for October 6, 2026 and the dividend payment date for October 13, 2026 at the earliest.

Read the Financial Statements Bulletin 2025

More information about the Annual General Meeting 2026

Information regarding withholding tax

Information for nominee registered non-resident shareholders:

According to a guidance given by the Finnish Tax Administration (“FTA”), stricter conditions are applied to withholding tax rates on dividends paid to nominee registered non-resident shareholders.

If a nominee registered non-resident shareholder is eligible for a lower withholding tax rate based on a double taxation treaty but a higher withholding tax is levied on the dividend, the shareholder can either apply for a so called quick refund from the custodian bank during the year of the dividend payment or apply for a withholding tax refund from FTA on a year following the dividend payment.

Link to new FTA guidance on nominee registered shareholders’ withholding taxation

Link to FTA guidance and forms on withholding tax refunds (individuals)

History

Kemira has paid dividend since its listing (1994).

| | Dividend per share, EUR* | Total, EUR million | Dividend payout ratio, % 1) | Dividend yield, % 2) |

|---|---|---|---|---|

| 2024 | 0.74 | 114 | 46 | 3.9 |

| 2023 | 0.68 | 104.5 | 53 | 4.1 |

| 2022 | 0.62 | 95 | 41 | 4.3 |

| 2021 | 0.58 | 89 | 83 | 4.4 |

| 2020 | 0.58 | 89 | 67 | 4.5 |

| 2019 | 0.56 | 85 | 79 | 4.2 |

| 2018 | 0.53 | 81 | 91 | 5.4 |

| 2017 | 0.53 | 81 | 102 | 4.6 |

| 2016 | 0.53 | 81 | 88 | 4.4 |

| 2015 | 0.53 | 81 | 84 | 4.9 |

| 2014 | 0.53 | 81 | 84 | 5.4 |

| 2013 | 0.53 | 81 | 76 | 4.4 |

| 2012 | 0.53 | 81 | 69 | 4.5 |

| 2011 | 0.53 | 81 | 59 | 5.8 |

| 2010 | 0.48** | 73 | 61 | 4.1 |

| 2009 | 0.27 | 41 | 37 | 2.6 |

| 2008 | 0.25 | 30 | 86 | 4.2 |

| 2007 | 0.50 | 61 | 95 | 3.5 |

| 2006 | 0.48 | 58 | 50 | 2.8 |

| 2005 | 0.36 | 44 | 49 | 2.7 |

| 2004 | 0.34 | 41 | 53 | 3.4 |

| 2003 | 0.33* | 39 | 52 | 3.6 |

| 2002 | 0.30 | 36 | 49 | 4.6 |

| 2001 | 0.30 | 36 | 52 | 4.5 |

| 2000 | 0.30 | 37 | 18 | 5.6 |

| Cash dividends in total |

1,720.5 | | | |

| Tikkurila in 2010** | | 599 | | |

| GrowHow in 2003* | | 161 | | |

| Companies as dividends in total | | 760 | | |

| Dividends in total | | 2,480.5 | | |

* In 2003, GrowHow shares were distributed as a dividend to a total amount of EUR 161 million (EUR 1.34 per shares).

** In 2010, Tikkurila shares were distributed as a dividend to a total amount of EUR 599.3 million (EUR 3.95 per shares).

1) Dividend / Earnings per Share or Operative Earnings per Share if available

2) Dividend yield calculated using the share price at the end of respective year

Kemira went over to IFRS reporting as of 1 January 2004.