Kemira as an investment

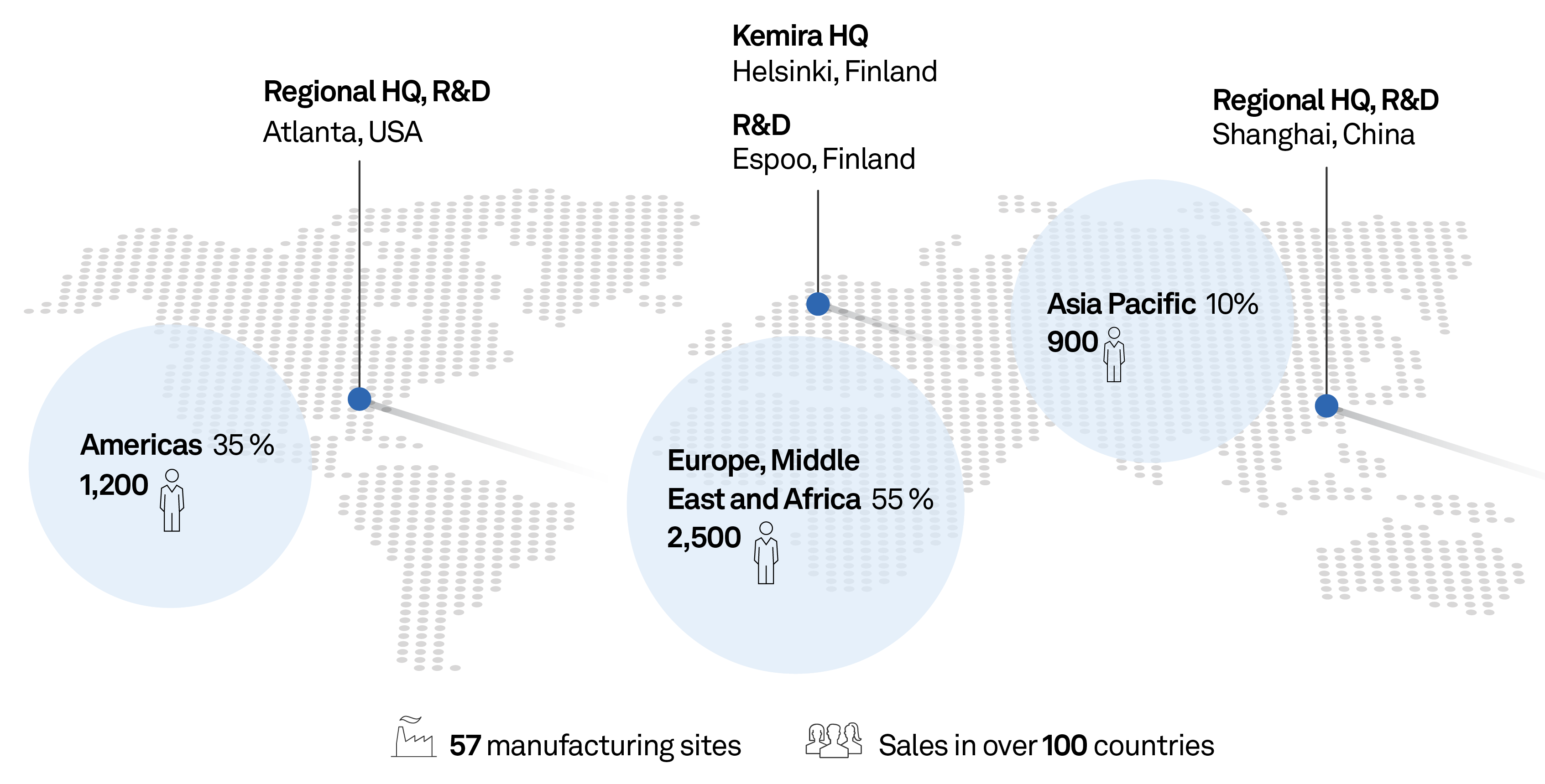

Global reach – local excellence

Kemira (Nasdaq Helsinki) provides a global supply of reliable chemistry and process expertise, enabling resource responsible business and better productivity for our customers in water intensive industries.

With over 100 years of experience, we partner with municipal water utilities, as well as pulp, paper, board and tissue producers to deliver visible improvements with our invisible enabler – the chemistry expertise of our 5,000 people.

In 2023, Kemira’s revenue was EUR 3.4 billion.

Resilient business model throughout cycles

Strong profitability improvement track record

Focus on profitable sustainable growth.

Operative EBITDA margin 19.7% and operative EBIT 13.7% in 2023.

Attractive dividend

Competitive and over-time increasing dividend. Dividend for fiscal year 2023 EUR 0.68 per share (2022: 0.62) and to be paid in two installments.

Sustainability at the core of strategy

Kemira will become the leading provider of sustainable chemical solutions for water-intensive industries.

Strategically fit for future

Global trends

Changing demographics

Higher use of water, energy, tissue & board.

Growing environmental awareness

New materials to enable circular economy.

Material and resource efficiency.

Our strategy

Sustainability

Sustainability transformation driving profitable growth – by the end of 2030 over 500 million of our revenue will come from renewable solutions portfolio.

Profitable growth

Our target is to grow above-the-market with an operative EBITDA margin of 15-18%.

We enable our customers to improve their water,

energy and raw material efficiency

Our customers

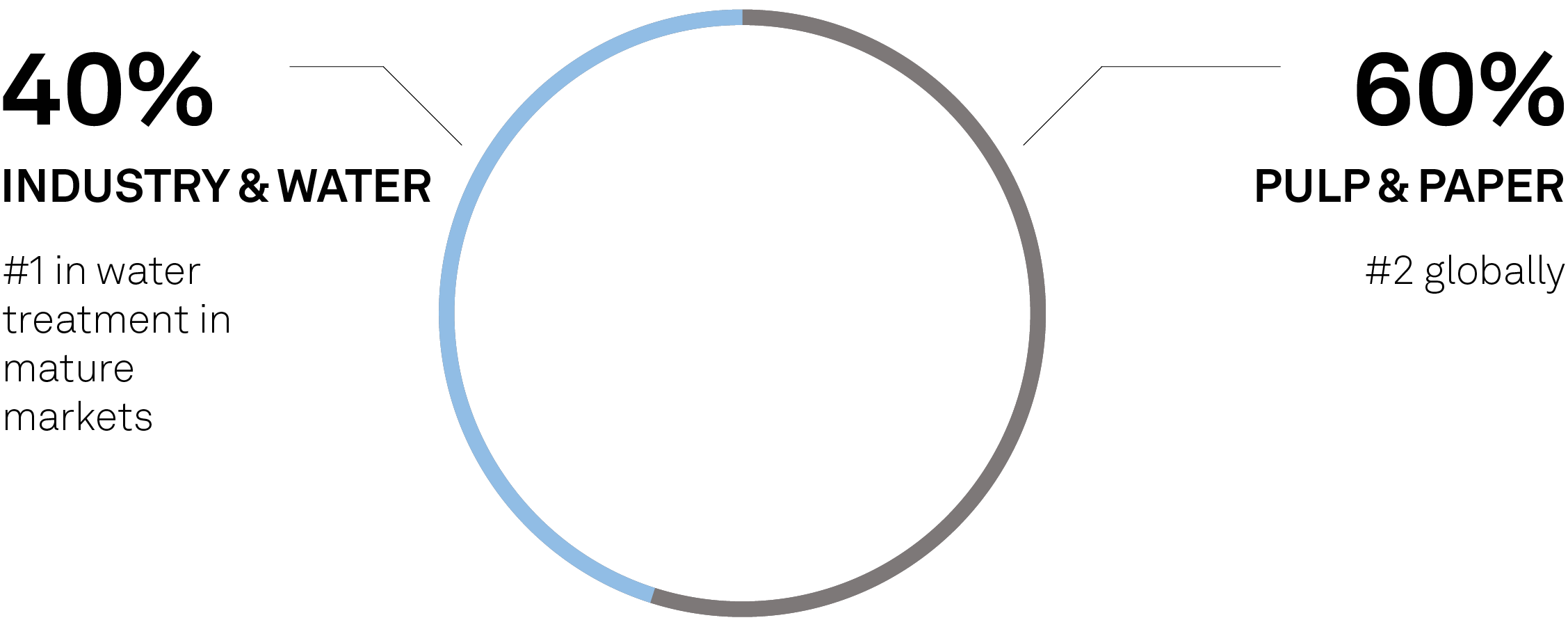

| Pulp & Paper | Industry & Water |

Our offering

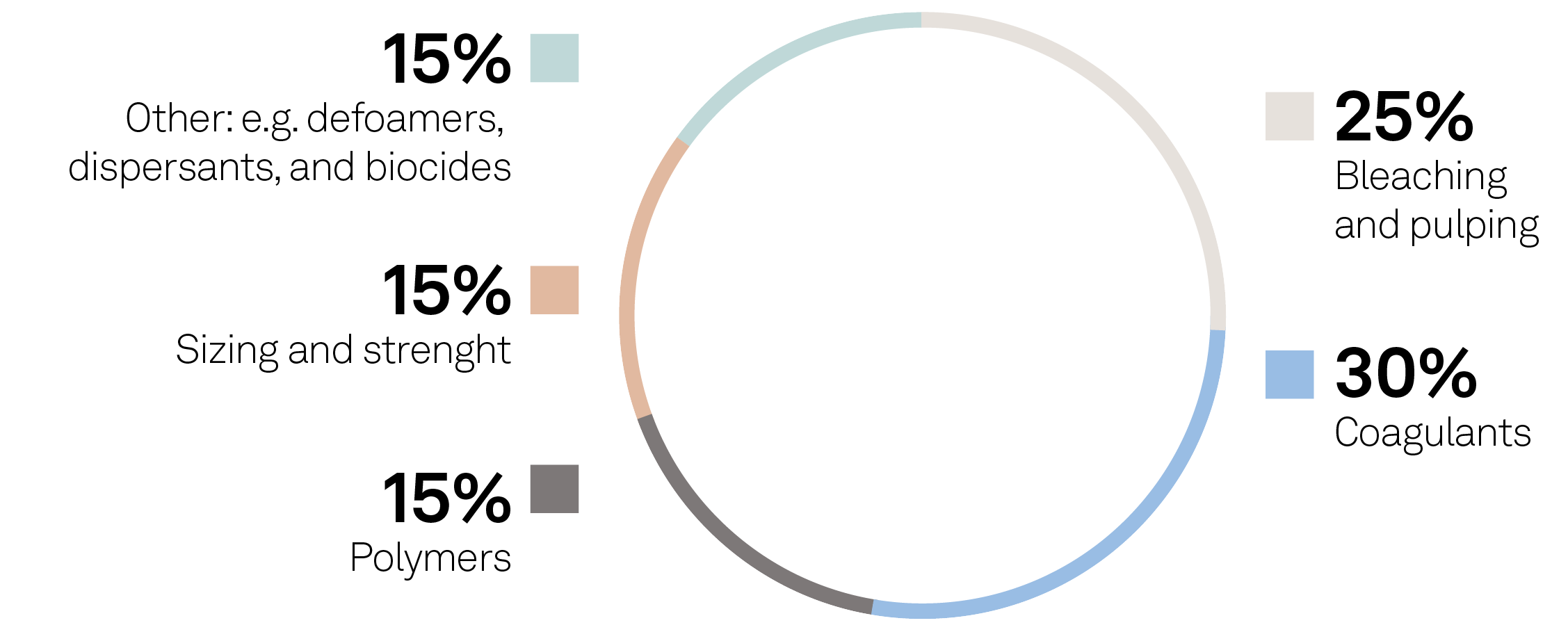

We provide expertise, application know-how and chemicals that improve our customers‘ product quality, process and resource efficiency.

Segment split

Products

Innovations

Innovations

Innovating together with our customers’ to improve water, energy and raw material efficiency. Research and Development expenses totaled EUR 34.2 million in 2023 representing 1.0 % of the Group’s revenue. Kemira has altogether approximately 2,040 patents and c. 420 patent families.

Achievements in 2023:

- New product development projects: 11. 82% of them aiming to improve customers’ resource efficiency.

- New priority patent filings: 55

Innovative digital services as a future business enabler

KemConnect™ services enable data-driven chemistry management. Our solutions for real-time monitoring, advanced process control and optimization, and predictive analytics build transparency, provide a deeper understanding of processes, and enable proactive and timely actions in operations. By harnessing the power of data, our customers can increase their efficiency, quality, and profitability.

Digital services for pulp & paper

Digital solutions for water treatment

Purpose-driven culture with growth mindset

Chemistry with a purpose.

Better every day.

Kemira’s purpose illustrates the importance of chemistry in our everyday life and relates strongly also to sustainability. Our results-oriented and collaborative culture inspires and empowers our people to solve societal challenges and make a positive impact. We call it better every day.

Values

We drive performance and innovation.

We are dedicated to customer success.

We care for people and the environment.

We succeed together.

Investor contacts

Mikko Pohjala