What is Kemira’s vision and strategy?

Our vision is to be the first choice in chemistry for water intensive industries.

Kemira is a great product company with chemistry and selling of chemicals at the core of our business. We win with best suited products and tailored services that improve our customers product quality, process and resource efficiency. Our target is to grow above-the-market with an operative EBITDA margin of 15-18%.

Read more about Kemira’s strategy.

What drives growth in Kemira’s markets?

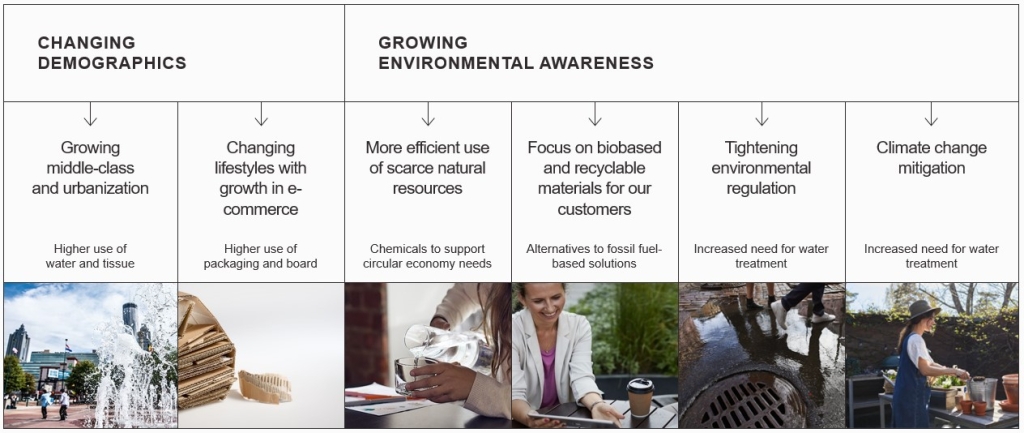

Changing demographics and growing environmental awareness are two most important trends driving growth of Kemira’s end markets.

Changing demographics

A growing middle-class population, particularly in Asia-Pacific, is expected to result in higher use of water, which will ultimately drive the demand for water treatment chemicals. Changing lifestyles and growth in e-commerce, partly driven by higher income per capita, will lead to higher need for packaging solutions globally. This will further boost the demand for pulp and paper chemicals; Kemira’s core expertise.

Growing environmental awareness

The overall sustainability trend, including more efficient use of natural resources and higher need for recyclable products, is expected to be beneficial for Kemira’s end-markets. Kemira’s solutions enable its customers to use resources, water included, more efficiently. One particular trend, the replacement of plastic packaging, is expected to drive growth of fiber-based packaging solutions. This in turn is expected to increase the demand for pulp and paper chemicals.